Income Tax Slab For Ay 2025-24. A new tax regime has been established by the insertion of section 115 bac in the income tax act, 1961 vide the finance act, 2025. In the union budget 2025, the finance minister announced significant changes to the new income tax regime.

In the new income tax regime, the tax rebate limit ( basic income tax exemption. A new tax regime has been established by the insertion of section 115 bac in the income tax act, 1961 vide the finance act, 2025.

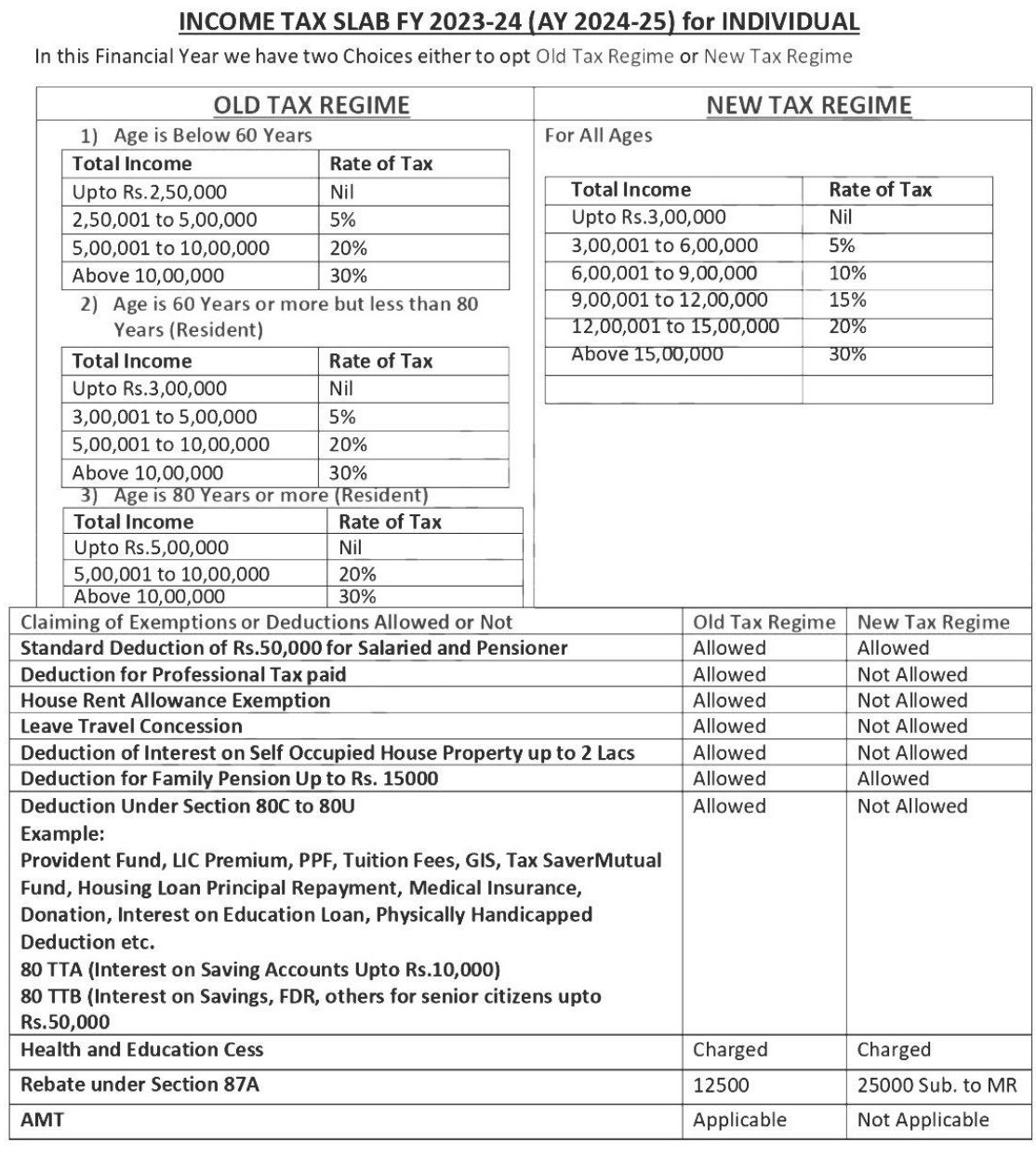

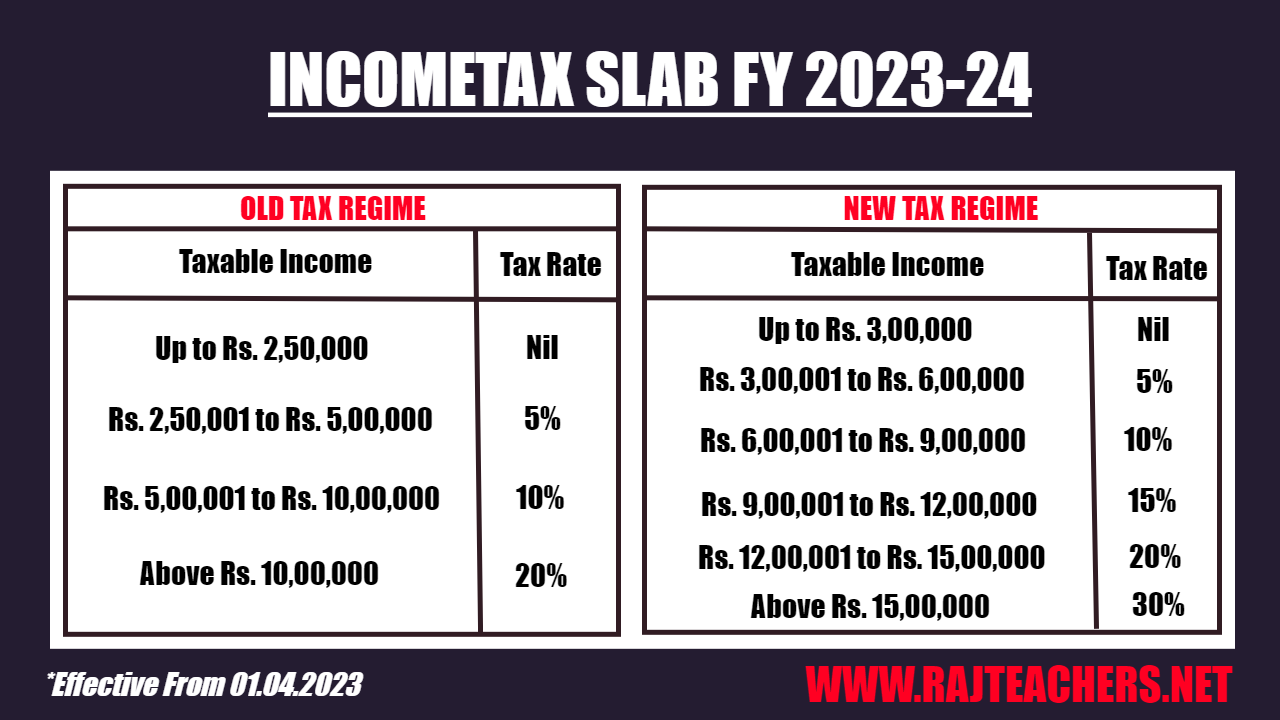

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), Currently, we have two different income tax regimes for tax slabs:

TAX SLAB FY 202324 (AY 202425) for INDIVIDUAL, The general slab rates applicable in the case of an individual or huf are 5%, 20%, and 30%.

Tax Slab Rates For Ay 202425 Megen Sidoney, Get the information about the old and new income tax slabs for individuals, senior citizens and super senior.

Know the New Tax Slab Rates for FY 202324 (AY 202425, The basic exemption limit has been hiked to rs 3 lakh from rs 2.5 currently under the new income tax regime in budget 2025.

NEW TAX REGIME TAX SLAB AY 202425 (202324) I TAX SLAB, This article focuses on the tax slab rates, surcharges, and exemptions for individual taxpayers, senior citizens, super senior citizens, the association of persons.

Tax Slab for FY 202324 & AY 202425, According to the budget 2025 release, the new income tax slab rates for each individual.

Method Of Calculating Tax For Senior Citizen Pensioners, According to the budget 2025 release, the new income tax slab rates for each individual.

World Space Week 2025 Uk Tickets. World space week is an international celebration of space […]